The Appeal of Algorithmic Trading: Unlocking Opportunities for Software Developers

Algorithmic trading is an enticing domain that has garnered the interest of many software developers, especially those with an interest for the financial markets. Essentially, it involves employing computer programs to automate trading decisions, a practice that’s gaining traction, particularly with the advent and mainstream acceptance of cryptocurrencies.

With algorithmic trading, developers can minimize the manual effort and emotions traditionally entwined with trading, enhance efficiency and accuracy, gain access to real-time data and market analysis, and tackle challenging problems and innovations. This article delves into why software developers are gravitating towards algorithmic trading and how it unfolds a plethora of exciting opportunities for us. So without further ado, let’s explore the allure of Algorithmic Trading for Developers

What is Algorithmic Trading?

Algorithmic trading refers to the use of computer programs and algorithms to execute trading strategies in financial markets. In simpler terms, it’s like having a robot that automatically buys and sells financial instruments on your behalf. Sounds cool, right? Well, it’s not just cool, it’s also a very lucrative field. Imagine making money while you sleep, or when on vacation!

Algorithmic trading provides a whole new world of opportunities for programmers to showcase their skills and creativity. From reducing manual effort and emotions to accessing real-time data and market analysis, algorithmic trading offers a host of benefits for developers. Let’s explore these opportunities!

A short history lesson about algorithmic trading

Using algorithms to perform trading tasks is not something new, Wall Street has been using these tools in the last fifty years. A short history lesson:

Early Attempts (1970s): The initial attempts at algorithmic trading were made in the 1970s with the development of computerized systems that could track market prices and make trades based on predefined criteria.

Electronic Trading (1980s): The move toward electronic trading platforms in the 1980s facilitated faster trade execution and improved efficiency, laying the groundwork for more sophisticated algorithmic trading strategies.

Deregulation and SOES (1980s-1990s): The deregulation of the financial markets and the introduction of the Small Order Execution System (SOES) in the aftermath of the 1987 stock market crash were pivotal in establishing a fertile ground for algorithmic trading.

High-Frequency Trading (2000s): With advancements in technology, high-frequency trading (HFT) emerged in the early 2000s. HFT is a form of algorithmic trading characterized by high speeds, high turnover rates, and high order-to-trade ratios.

Further Advancements (2010s): Over the last decade, advancements in machine learning and artificial intelligence have further pushed the boundaries of what’s possible with algorithmic trading, making it an integral part of the financial markets.

As institutions and Wall Street have adapted more complex and refined high-frequency algorithms it becomes even harder to make any profits from the markets. Why should software developers not leverage their skills and create their own systems?

Benefits of Algorithmic Trading for Software Developers

Algorithmic trading offers several benefits for software developers who are looking to tap into the world of finance.

Firstly, it allows them to reduce manual effort and eliminate emotional biases from the trading process, this is something that applies especially to people with ADHD, like myself. No more sitting in front of the screens for hours on end, making impulsive decisions based on gut feelings. With algorithmic trading, developers can automate their strategies and let the computer do the heavy lifting.

Secondly, algorithmic trading increases efficiency and accuracy. Computers can process vast amounts of data and execute trades at lightning speed, which is impossible for us humans to achieve. This not only saves time but also reduces the likelihood of errors caused by human intervention. This point is especially important if your trading style is more scalping-based.

Thirdly, algorithmic trading provides software developers access to real-time data and market analysis. Of course, this is also true when using platforms like TradingView, but this allows them to hook up the program on real-time data and analyze the current market faster than a human could do. By staying ahead of the game, developers can capitalize on profitable opportunities and avoid unnecessary losses.

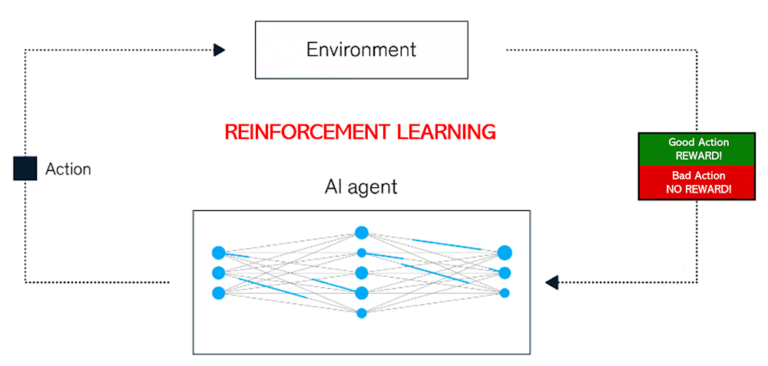

Lastly, using next-gen tools like ChatGPT or other LLM’s we can supercharge our development process and let us work on new innovations. Often creating a full algorithmic trading bot consists of a lot more than just writing the code. Multiple strategies need to be back and forward tested, and AI can help us here as well. If you want to go even further, reinforcement learning is a branch within machine learning that can be used to write sophisticated trading bots.

Overall, algorithmic trading opens up a new world of possibilities for software developers, providing them with the chance to automate their strategies, increase efficiency, access real-time data, and use innovative AI tools. So, if you’re a software developer looking for new and exciting opportunities, algorithmic trading might just be the perfect fit for you.

Reducing Manual Effort and Emotions

The struggle with manual trading

Imagine a trading session, and you are trying to make quick decisions in the heat of the moment. It can be stressful, right? At these vital moments, emotions and thoughts deactivate our rational thinking, and we take irrational actions, most of the time resulting in a loss. This is a cycle that keeps repeating for many months or even years.

Many traders do find a strategy that suits them, and after back-testing it net gains in the long run. But sticking to that strategy is the hard part, day in and day out. Often on the surface, it looks like a lack of discipline, but when we analyse our mistakes the problems go a lot deeper. Some reasons can be:

1) Not having a clear trading plan for your desired setup

We have a general idea of our trading setup but have not written it down in detail. This means that on some occasions, we are not sure if the setup checks all our boxes.

2) Emotion’s making us doubt

After having a losing streak, you might start to doubt the strategy and be hesitant when a potential trade arises. We forget that it’s a number game, and if the strategy is sound it will net positive in the long run. The opposite can also be true, after having a couple of winners we might think that we are “better” than the market and start to make silly mistakes.

3) Discipline, okay, maybe discipline is by itself a valid point ; )

Having traded in the past in a certain way might make you execute trades that are not within your current strategy. If the current strategy deviates a lot from your previous strategy, it is hard to not pull the trigger when a setup arises that you have always traded.

But fear not, algorithmic trading is here to save the day. With its automated systems, you can bid farewell to manual effort and excessive emotions.

Automating emotions away

By implementing algorithms, you can let the code do the heavy lifting for you. Say goodbye to those daily moments analyzing the market structure and other information you want to analyze before starting your session. With algorithmic trading, you can rely on your software to execute trades based on predefined rules and strategies.

Not only does this reduce the likelihood of human error, but it also removes the emotional aspect of trading. No more impulsive decisions driven by fear or greed. Instead, you can trust in the logic of your algorithm to make calculated and rational choices.

And the best part? You can finally reclaim your personal life from the clutches of constant market monitoring. With software taking care of the trades, you can spend the spare time that was previously occupied by watching markets, doing analysis, or executing and monitoring trades with other productive tasks, like improving your algorithm, or just relax and spend more time with family and friends.

So, fellow coders, embrace the wonders of algorithmic trading and bid farewell to manual effort and emotional roller coasters. Let your code be your superhero in the realm of finance!

Increasing Efficiency and Accuracy

Speed and Precision: The Dual Advantages

Algorithmic trading offers software developers the opportunity to significantly increase efficiency and accuracy in the financial markets. By automating trading strategies, developers can eliminate the need for manual effort and remove the influence of emotions in decision-making. This means no more late nights spent analyzing charts and no more impulsive trades based on gut feelings.

With algorithmic trading, software developers can rely on pre-defined rules and logical algorithms to execute trades. This reduces human error and ensures that trades are executed at the optimal time and price. It also allows for faster execution, as trades can be automatically sent to the market without any delay.

If you are already a very “mechanical” trader and might sometimes miss a setup, or just be slightly too late with your execution, using algorithms will remove all these problems.

How Algorithms Amplify Trading Performance

Furthermore, algorithmic trading provides the ability to backtest and optimize strategies using historical data. This allows developers to fine-tune their algorithms and identify the most profitable trading parameters. By continuously monitoring and analyzing market data developers can make data-driven decisions and adapt their strategies in real-time. Having access to this real-time data via APIs, and leveraging historical data backtesting can be done programmatically as well. No more hour-long back-tasting sessions in replay mode 😉

In summary, algorithmic trading empowers software developers to trade more efficiently and accurately. It saves time, reduces emotional bias, and maximizes the potential for profitable trades. So, if you’re a software developer looking for an exciting challenge and an opportunity to make a potentially significant impact on your financial situation, algorithmic trading is definitely worth considering. Say goodbye to tedious manual trading and hello to the world of automated, precise trading strategies.

Access to Real-time Data and Market Analysis

In the world of algorithmic trading, real-time data and market analysis are like gold. Software developers and data engineers get to dive into a pool of live information, giving them a competitive edge. They can access streaming market data, news feeds, and economic indicators, all at the click of a button. This real-time data allows developers to make quick decisions and implement strategies that can take advantage of market shifts or incorporate all these variables into an extensive strategy.

With access to comprehensive market analysis, software developers can fine-tune their strategies and adapt to changing market conditions. They can identify profitable opportunities and maximize their trading success.

Using AI tools to improve our development experience

If you’re a software developer who thrives on tackling challenging problems and pushing the boundaries of innovation, algorithmic trading is the perfect field for you. The world of algorithmic trading is constantly evolving, presenting engineers with exciting opportunities to create groundbreaking strategies and solutions.

In this fast-paced industry, you’ll be faced with the task of designing algorithms that can process vast amounts of data in real time, make split-second decisions, and execute trades with accuracy. It’s a true test of your coding abilities and problem-solving skills.

Often this results in having to have a lot of specific domain knowledge. If you have only worked on creating front-ends with React you might have a hard time and need to add some programming languages and frameworks to your repertoire. An alternative would be to leverage the strengths of AI.

We can greatly use the power of AI to our advantage. It can help us learn a new language or explain complex concepts and patterns. Have issues creating a WebSocket connection to your trading platform client? Want to leverage Microsoft’s newest AutoGen for validating strategies by having it back-testing historical data? Have issues deploying your bot to the cloud or setting up solid infrastructure? Tools like ChatGPT can help! You can even locally run a version of Meta’s Llama2 for free as an alternative to ChatGPT.

For most people, this still is a black box, and every week new tools are being released. Staying up to date and experimenting with this can have huge benefits.

Things to consider before starting

I have presented a very idyllic idea of what is possible when using algorithms to perform our trading tasks. However, there are a lot of things to consider.

Preparing for the Algorithmic Trading Journey

Don’t think this will be a walk in the park. Before writing your first bot or application you need a very solid knowledge of trading and programming. Having bought some crypto two years ago does not count. Doing proper analysis and having sufficient knowledge is half the work and will prevent you from having to spend hours on end trying to understand certain concepts and fixing bugs.

Delving into this realm is not really worth your time if you don’t have some trading knowledge. You need to at least be aware of your desired style and what you want to use your software for. Are you a scalper that uses purely mechanical triggers, then this is an optimal approach. But if you are a swing trader, that takes into account macro-economical events then this might not be your cup of tea.

Are you trading using indicators, well figure out how to write them in code. Do you only use market structure, how do you translate highs and lows into your algorithm? Where do you want to store your candle data, Redis, or maybe some other cache? How will you manage risk? Does your broker even have an API you can talk to? These are just some questions that you will have to think about. It’s important to have an idea, but also do an extensive analysis before starting to answer these kinds of questions.

Still excited and not discouraged? Well, I’m glad 🙂 Most developers are aware of these things, and if you were not, it is a small but needed reality check.

Conclusion

Algorithmic trading offers a plethora of benefits for software developers. It reduces manual effort and eliminates emotions from trading decisions, allowing for a more disciplined approach. It enhances efficiency and accuracy by automating repetitive tasks and executing trades at lightning speed. Developers enjoy access to real-time data and market analysis, helping them make informed decisions. Furthermore, they get to work on challenging problems and can use AI tools to speed up the development process.

Developing a fully functioning and profitable trading bot requires a deep understanding of financial markets, trading platforms, and software development skills. Even after successfully running your initial bot, continuous fine-tuning and testing of different strategies are necessary. This process demands a significant investment of time, but the financial benefits can greatly outweigh this effort. Once you have a fully operational system, it has the potential to generate income passively. Isn’t that something we all desire? So why wait? Engage in this captivating field and unlock unlimited possibilities!

Currently, I am working on a scalping bot, which is written in C#. Interest in the process and challenges I’m facing? Stay tuned

Frequently Asked Questions (FAQs) – The Appeal of Algorithmic Trading

What is algorithmic trading?

Algorithmic trading refers to the use of computer programs and algorithms to execute trading strategies in financial markets. It automates the buying and selling of financial instruments, allowing for faster and more efficient trading.

Why is algorithmic trading appealing to software developers?

Algorithmic trading offers software developers several benefits. It reduces manual effort and eliminates emotional biases, allowing for a more disciplined approach to trading. It also increases efficiency and accuracy, as computers can process vast amounts of data and execute trades at lightning speed. Additionally, algorithmic trading provides access to real-time data and market analysis, allowing developers to capitalize on profitable opportunities.

How does algorithmic trading reduce manual effort and emotions?

With algorithmic trading, software developers can automate their trading strategies and let the computer execute trades based on predefined rules and algorithms. This eliminates the need for manual analysis and decision-making, reducing the emotional aspect of trading.

What are the advantages of algorithmic trading in terms of efficiency and accuracy?

Algorithmic trading allows for faster execution of trades as computers can execute them at lightning speed. It also reduces the likelihood of human error caused by manual intervention. By automating trading strategies, developers can fine-tune their algorithms and optimize them for maximum profitability.

How does algorithmic trading provide access to real-time data and market analysis?

Algorithmic trading allows software developers to access streaming market data, news feeds, and economic indicators in real-time. This provides them with a competitive edge, allowing for quick decision-making and the ability to adapt to market shifts.

What AI tools can be used to improve the development experience in algorithmic trading?

Software developers can leverage AI tools like ChatGPT or other language models to improve their development experience in algorithmic trading. These tools can help with language understanding, complex concept explanations, and even aid in backtesting strategies. Additionally, using machine learning techniques like reinforcement learning can result in sophisticated trading bots.

What should software developers consider before starting algorithmic trading?

Before starting algorithmic trading, software developers should have a solid understanding of trading and programming. It’s important to formulate a clear trading plan, including the desired setup, indicators, risk management strategies, and the choice of a trading platform with API access. Proper analysis and research are essential before diving into algorithmic trading.

Are there any limitations or challenges to consider in algorithmic trading?

Yes, algorithmic trading requires continuous monitoring, testing, and fine-tuning of strategies. It demands a significant investment of time and effort to develop and maintain a profitable trading system. Additionally, developers need to stay updated with market trends, technological advancements, and regulatory changes.

Can algorithmic trading guarantee profits?

Algorithmic trading is not a guaranteed path to profits. While it can increase efficiency and accuracy, trading always carries risks. Successful algorithmic trading requires a deep understanding of financial markets, constant strategy improvement, and adaptability to market conditions.

Is algorithmic trading suitable for all software developers?

Algorithmic trading is best suited for software developers with a strong interest in finance and trading. It requires a solid understanding of both programming and trading concepts. Developers with the ability to analyze market data, design algorithms, and continuously improve strategies will find algorithmic trading appealing.